Home loan research, done for you.

Mortgage Info is the easy way to get the home loan information you need to get approved, & to save money.

How can we help your Home Loan research?

Connect with mortgage brokers who know their stuff.

Mortgage Info is a free service that empowers Australians with the expertise they need to get finance approved, and to find a better home loan deal.

We provide information on home loans, and connect everyday Aussies with experienced mortgage brokers willing to share their knowledge.

The professional mortgage brokers we work with are 100% licensed, and accredited with top banks and non-bank lenders.

Often they will have access to dozens of home loan lenders encompassing thousands of individual mortgage products.

Make your property dreams come true.

Whether you’re a first home buyer, an existing home owner looking to upgrade, or you want to take the leap into property investing, it all starts with getting the right information.

Mortgage Info publishes a range useful guides and connect you to knowledgeable brokers who can help you get into next property sooner.

We can help:

Some of the lenders our licensee is accredited with

Refinance your home loan, like a pro

According to the Australian Bureau of Statistics (ABS), there are currently approximately 6 million active mortgages in the market. Each year about 8 per cent of those mortgage holders (450,000) refinance to another lender.

So refinancing is very popular. And it’s no wonder because, depending on how you handle the switch to the new home loan lender, there are some real potential benefits:

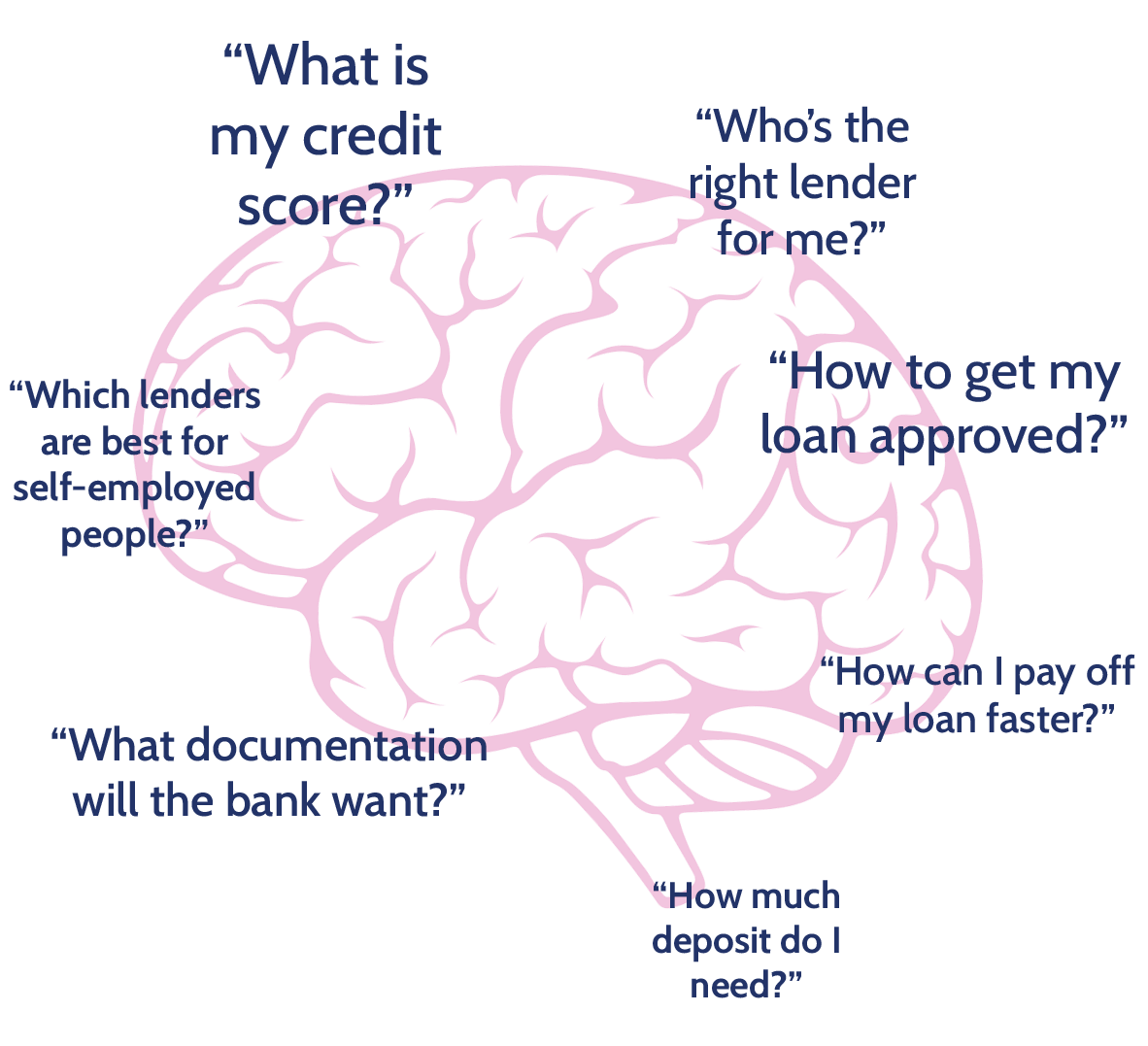

Get answers to your home loan questions.

Sure, the Home loans market is complex. But did you know it’s also dynamic?

Banks and lenders are constantly changing the key factors that determine which lenders should be on your shortlist:

This is what makes navigating the mortgage maze so difficult.

Mortgage Info is the easy way to get answers to your questions.

Ask us anything you like about home loans. We’ll connect you with an experienced broker who can help.

Frequently asked questions (FAQs)

Stay up to date with the latest tips & tools for pro communicators.

We only work with 100% licensed and accredited brokers, who are committed to sharing knowledge in order to help people like you. By connecting with a home loan broker through Mortgage Info, you can more easily access the information you need to get a loan application approved, and to find a better interest rate.

There is no cost to use Mortgage Info. We charge fees to our broker partners for the introduction to you, but there is no obligation for you to subsequently use their services. (Although most brokers in the Australian mortgage market do not charge fees directly to borrowers because they are paid commission by lenders, any fees a broker may seek to charge are unrelated to Mortgage Info.

In any instance where a mortgage broker may seek to charge a fee, they are legally required to disclose them upfront).